The Mindful Money

Practice.

Pay attention to your well-being, not just your numbers.

Learn more about why we are building Allo →

Join the Community

Every day, people use Allo to feel great about their finances and transform their relationship with money.

Allo has changed the way I spend and think.

"I’ve tried all the budgeting apps and while I’m not bad with money, my mindset is. The categories being connected to values has opened my eyes to how I’m spending. It’s been a freeing experience!"

Alex D

Feeling at peace with finances!

"The periodic element of Allo helps me keep on top of things without avoiding for too long and having sticker shock. Plus, for the first time I’m able to frame my finances in a light that makes me feel good!"

Katie S

The first money app I actually like!

"I look forward to using Allo everyday, which I have never said about any money app ... [It] is changing my behavior, in really gentle ways — that are gonna last."

Maria C

Healed my relationship with money!

"Unlike other budgeting apps, Allo helped me focus on my values ... It illuminated areas where I could cut back ... and areas I could release some anxiety around."

Susie T

I feel relaxed and grateful.

"It’s rewarding to create a gratitude practice around my money. My check-ins with Allo help me stay relaxed and grateful."

Jane W

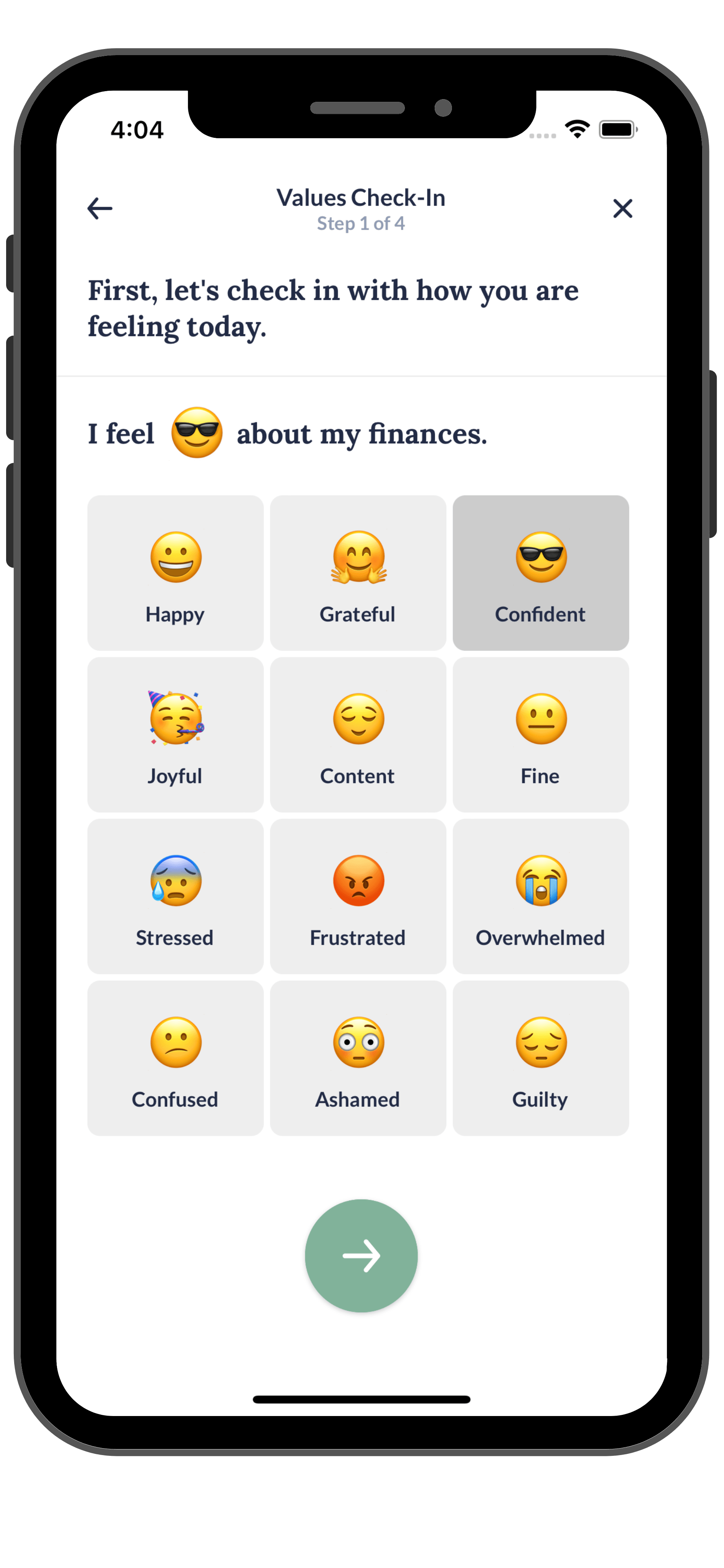

Guided by

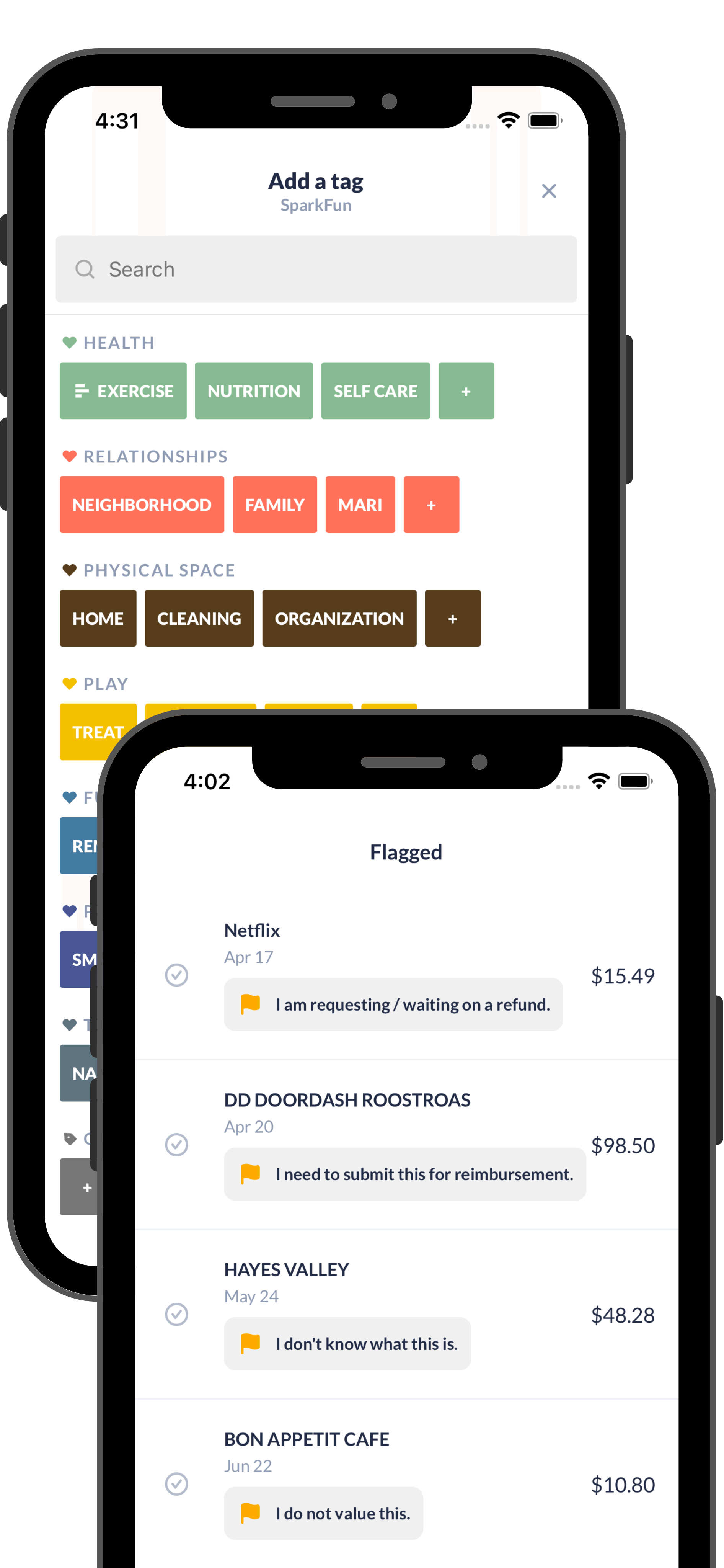

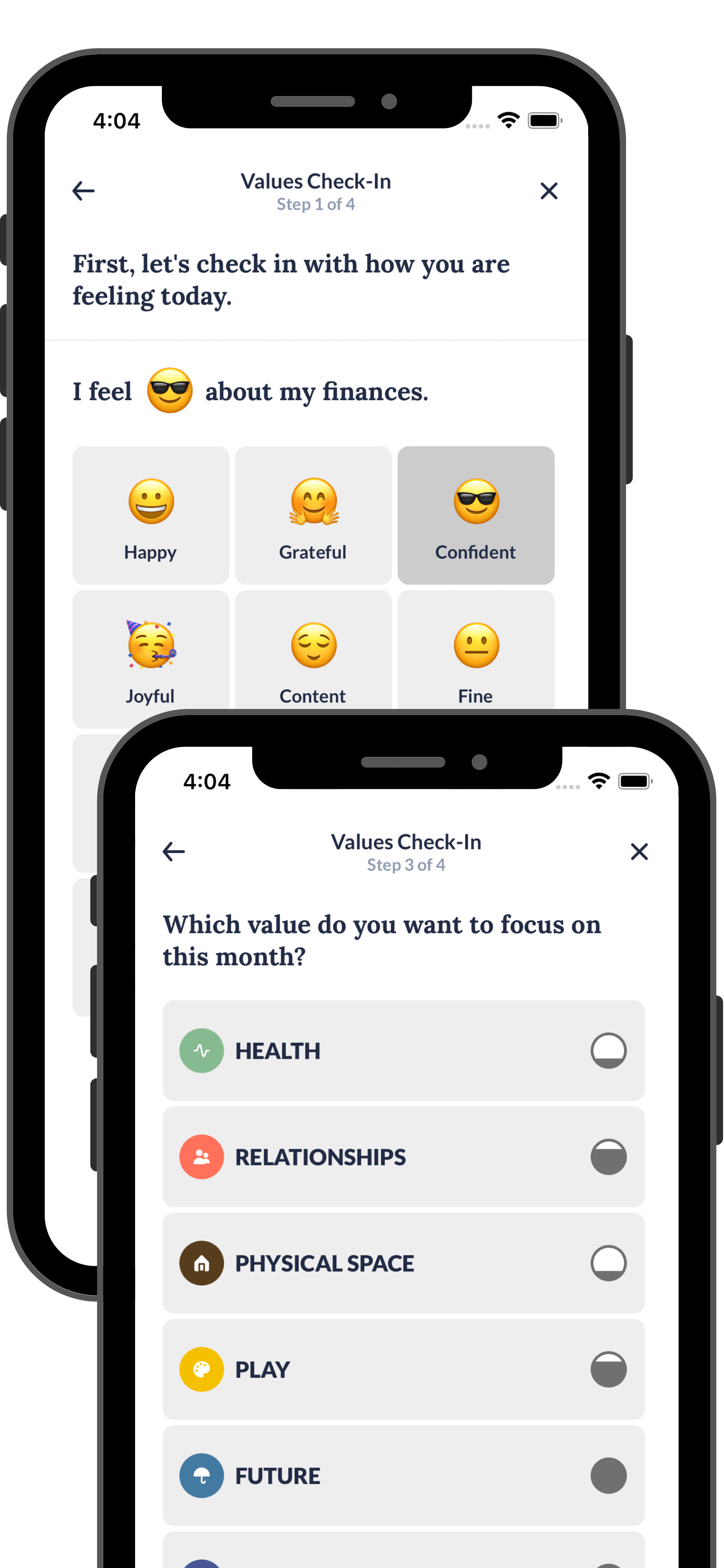

Your Values

Start with your why — what’s important to you and how you want to use your money.

Life is more than just the average budgeting categories like Bills, Transportation, Insurance, etc. It’s time your financial tool reflects that.

Designed for

Peace of Mind

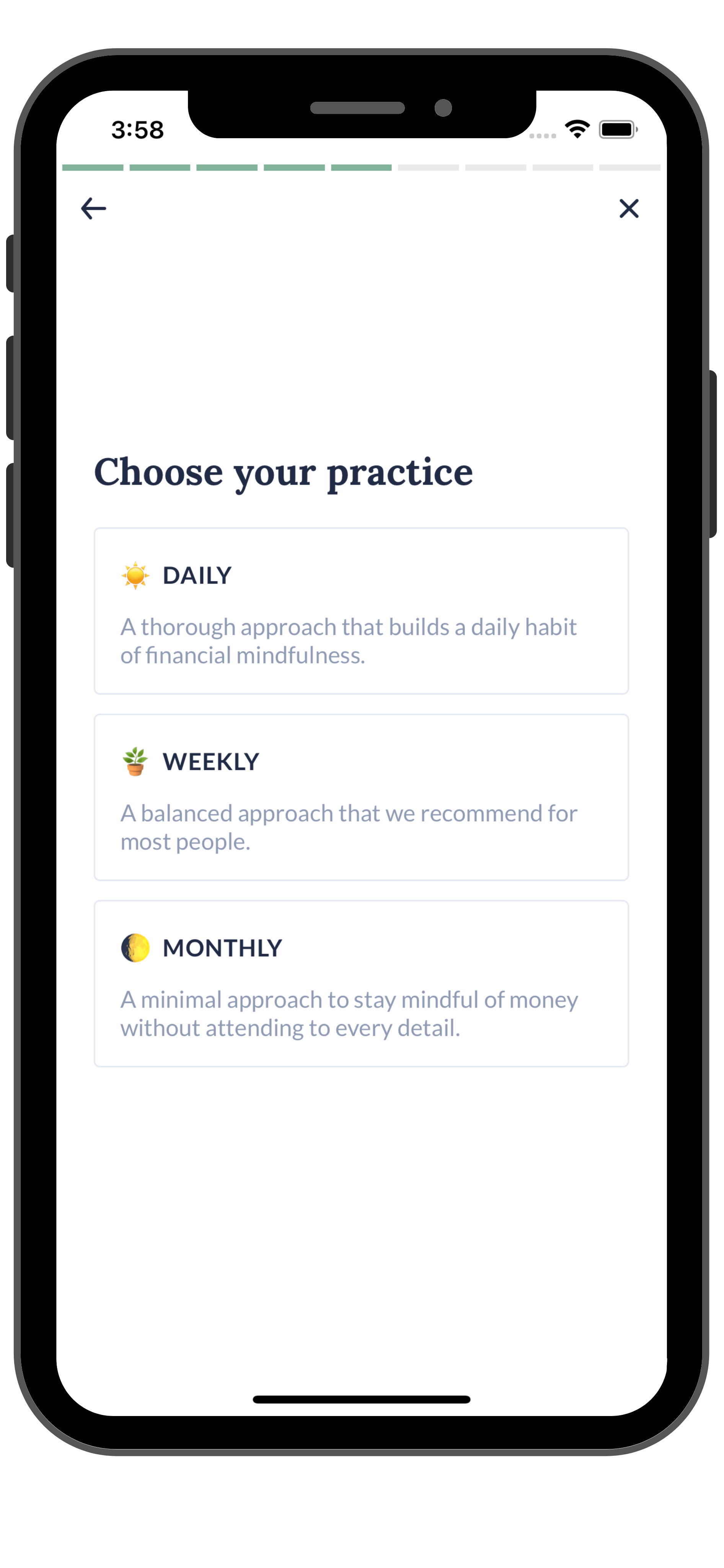

A regular practice with Allo — whether daily, weekly, or monthly — lets you be confidently aware of your finances, while not being so obsessed with it that you are trapped in your financial app 24/7.

It's about meaningfully engaging with money, then setting down the phone, and living your life anxiety-free.

Built for Change

We won’t lie. Real, material change in your financial life is hard and only achievable with time and patience. That’s why Allo helps build a habit that can last.

Allo sessions are deliberately kept simple and based on positive reinforcements. So it's easy to get started, and easy to stick with it.

Secure and Private

Allo uses bank-level security, and we do not store your financial credentials. We will never show you distracting ads or sell your financial data.

We are committed to building the best product to improve your financial life.

How Does It Work?

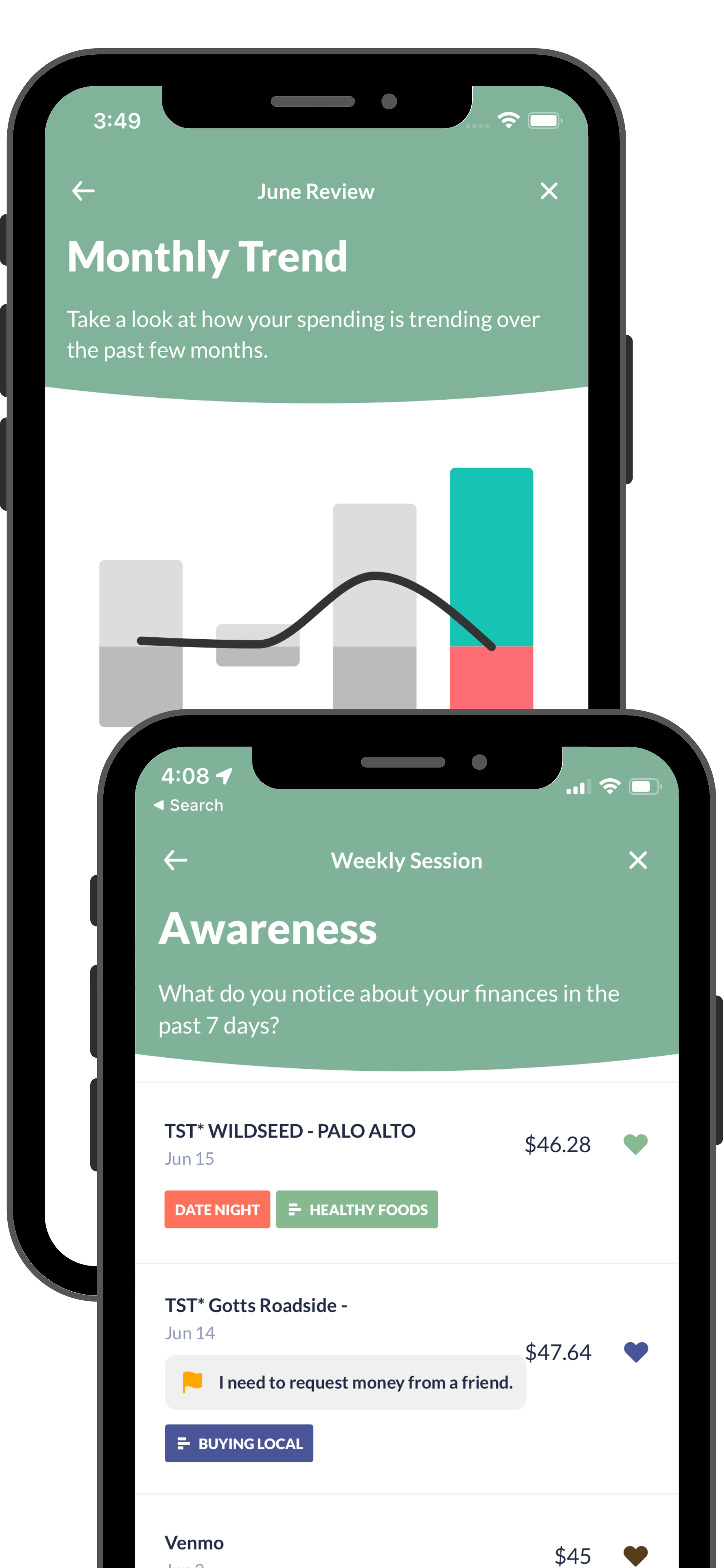

Review Your Numbers

See all transactions across your bank accounts and credit cards in one place.

Allo automatically surfaces everything since your last session, so you never miss anything.

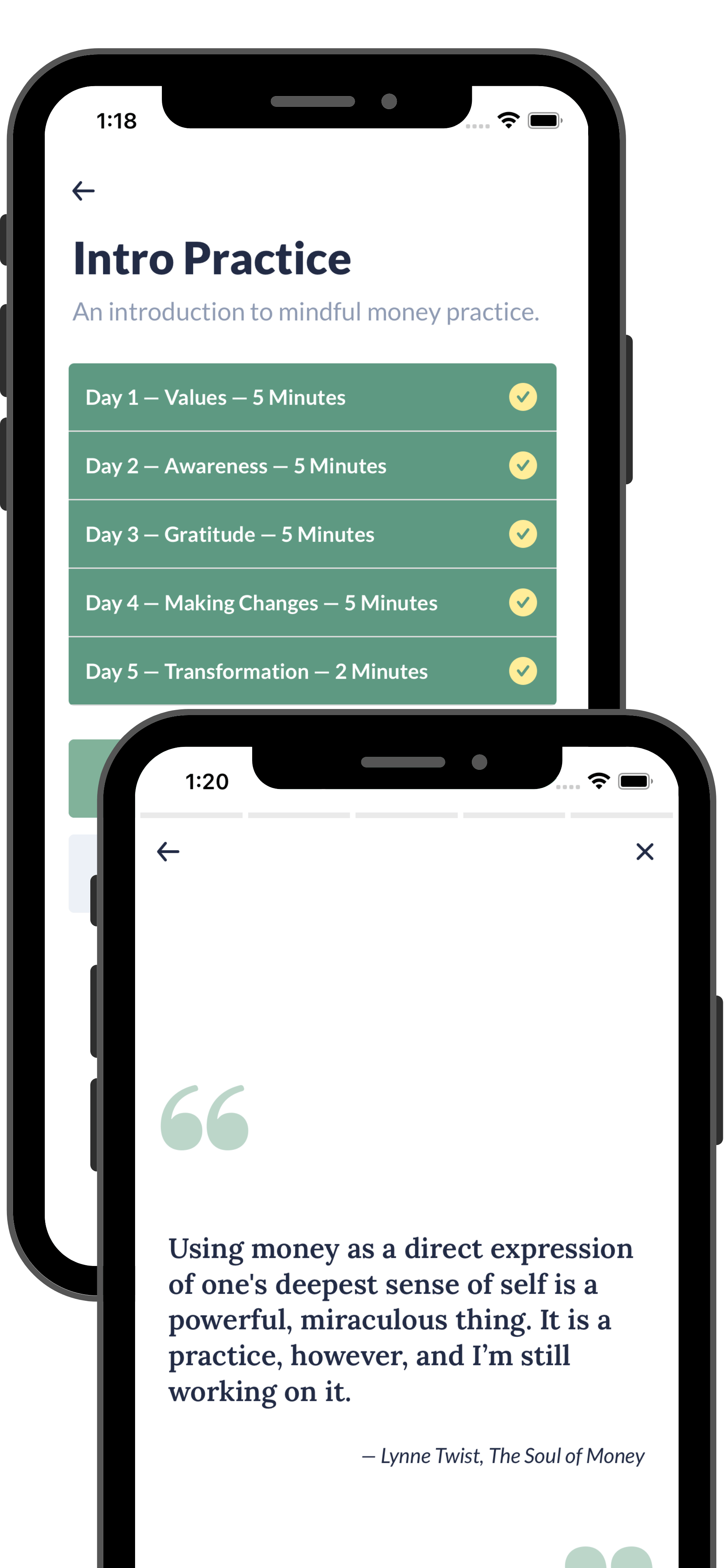

Guided Exercises

Start your journey with Allo’s introductory course and learn from experts how to feel more peaceful, confident and grateful.

Create Your Practice

At the end of the introductory course, create a daily, weekly, or monthly practice and focus on the values that you want to prioritize.

Tag and Flag

Be aware of the values that motivate your spending. Tag the values you want to track or celebrate. Flag things that deserves a second look.

Offload your to-do’s — things you don’t recognize, items to be refunded, or subscriptions to cancel — so you don't carry them in your head all the time.

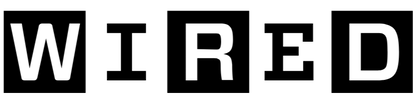

Emotions Matter

Check in with your feelings, and be intentional where you want to focus for the next month.

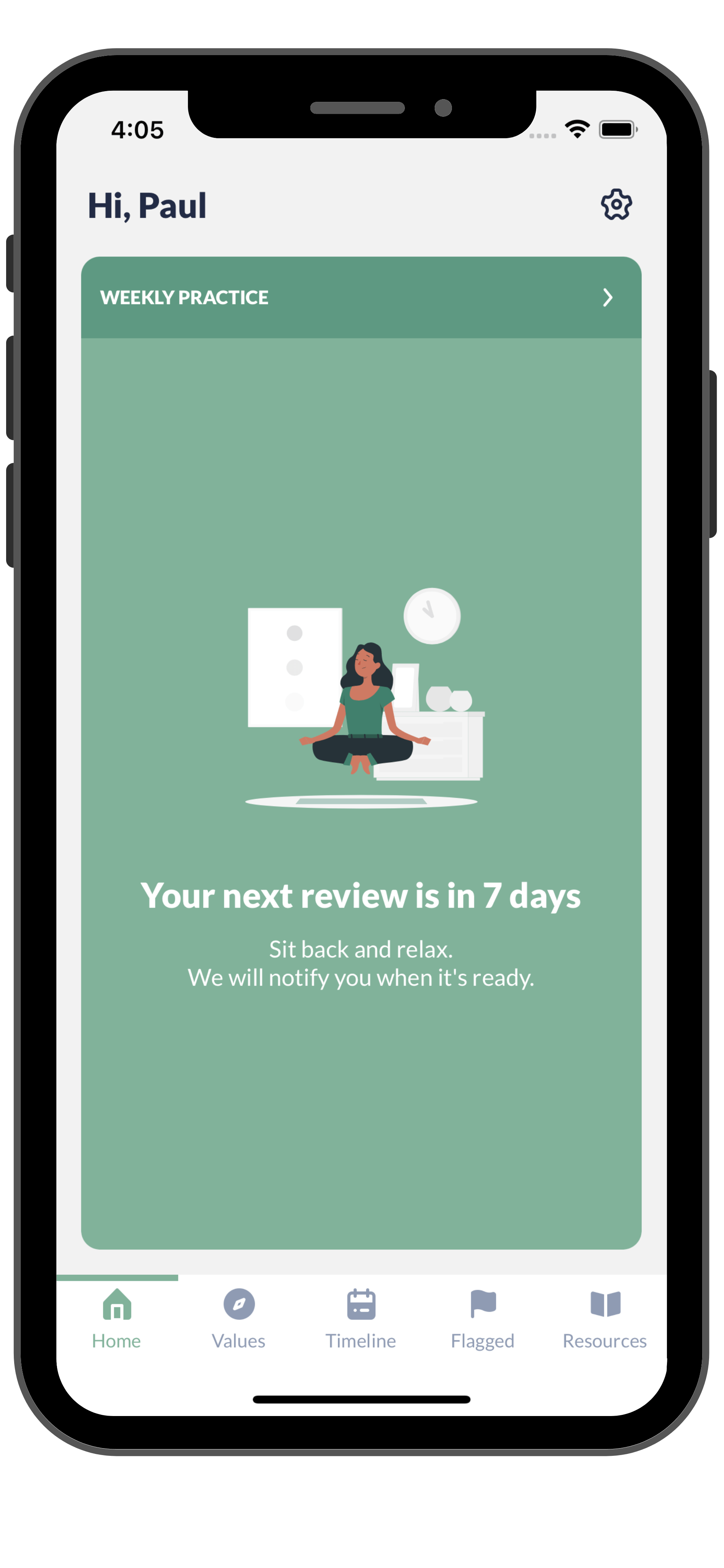

Sit Back and Relax

Some call it "inbox zero", others call it "that zen feeling". Allo only surfaces things you haven’t seen, so when you’ve reviewed everything, you know you are done.

No ads. No spam. No unwanted notifications.

Set down your phone and spend the rest of the time outside of the numbers.

FAQ

Is Allo Secure?

Allo uses bank-level security, and we do not store your financial credentials. We will never show you distracting ads or sell your financial data.

Will you show me ads or sell my data?

Absolutely not. Allo is ad-free, and we never sell your data. Your privacy is our utmost priority.

Do you offer a free trial?

Yes, you can enjoy a 14-day free trial of Allo with unlimited access. No credit card is required, and if you decide it's not the right fit, there's no need to worry about canceling.

How much does Allo cost?

Allo's subscription is priced at $49.99 per year, which comes to around $4 per month. We believe in making Allo accessible to all, so if you can’t afford it now, reach out to us, and we'll provide it for free.

How do I apply for a scholarship?

To apply for a scholarship, simply send an email to team@allo.finance, expressing your need. We're here to support you.

What about budgeting?

If budgeting works for you — great! The reality is that the ability to make and stick to a budget defies the realities of most people's lives. Expenses fluctuate a lot every month and we are generally too optimistic about what a reasonable budget should be. This requires a tremendous amount of willpower to stick to a budget and most of us end up giving up.

Does the word "budget" make you run away?

Us too! That’s why we built Allo. It’s for the majority of us that don’t love to budget. Being aware doesn't mean limiting yourself, it just means noticing what you have spent.

This doesn’t sound like fun.

While we may not offer amusing cat videos, Allo will bring you a sense of gratitude and joy through better financial awareness.

I already know how I spend. How will Allo help?

That's great! We think finding balance among the many priorities we have in life is a journey, not a destination. With Allo's regular practice, you can continue to work towards that balance and make your money go further towards the life you want to live.

I’m not sure I want to know where I’m spending my money.

We hear you. Money avoidance is very common. As you become aware of your spending some things will surprise you and some will bother you. As you become more aware you can then choose to make the changes that feel right for you.

Ready to Start?

Start your mindful money practice with Allo.